Ondas Targets Rafael Drone Unit in Israeli Defense Push

Check out the Best Deals on Amazon for DJI Drones today!

There is a new suitor circling one of Israel’s most sensitive drone makers.

US based Ondas Holdings is seeking to acquire Aeronautics, the unmanned aerial vehicle subsidiary of Rafael Advanced Defense Systems, according to reporting by Calcalist.

If approved, the deal would deepen Ondas’ rapid expansion into Israel’s defense sector. It would also ignite serious questions about classified technology, executive migrations, and Rafael’s longer term privatization ambitions.

Classified drones and security roadblocks

Aeronautics is not a hobby shop for quadcopters. It is deeply embedded in classified Israeli defense programs, including the “Storm Clouds” initiative, under which it supplies Orbiter 4 UAVs to the Israeli Air Force and Intelligence Directorate.

That means any potential sale must pass review by Israel’s Director of Security of the Defense Establishment. The same scrutiny has already delayed Ondas’ separate attempt to gain control of mPrest, the command and control software developer behind Iron Dome.

Photo credit: Rafael

Ondas is also reportedly interested in Controp, an electro optical systems company operating under Aeronautics. In other words, this is not a single acquisition attempt. It looks more like a coordinated expansion across Rafael’s technological core.

Security officials are particularly uneasy about two factors.

First, Ondas raised about $1 billion from an undisclosed major investor earlier this year. In a sector built on classified knowledge, mystery capital tends to trigger alarms.

Second, there has been a steady migration of former Rafael executives into Ondas. Among them is Maj Gen Yoav Har Even, former CEO of Rafael, now serving on Ondas’ advisory committee.

Other senior leaders have followed. For critics inside Israel’s defense establishment, this does not feel like normal talent mobility. It feels like strategic infiltration.

The shadow of a controversial past deal

The potential sale of Aeronautics carries historical baggage.

Rafael acquired Aeronautics in 2019 in a deal that was later criticized by Israel’s Government Companies Authority. The transaction, structured with businessman Avichai Stolero, was found to contain significant deficiencies. According to audit findings, Rafael absorbed most of the financial risk while Stolero secured strong upside protection.

In 2023, Stolero exercised an option forcing Rafael to buy back his stake at a valuation that effectively preserved his investment plus financing costs. Arbitration between the parties is still ongoing.

If Ondas were to offer a high valuation for Aeronautics, it could indirectly influence those financial dynamics.

Now add another layer. Ondas’ market value has surged to roughly $5 billion after nearly $2 billion in capital raises in 2025. Just a year ago, the company was fighting the risk of Nasdaq delisting. That kind of turnaround invites admiration from some corners and suspicion from others.

Rafael IPO pressure builds

All of this unfolds as Israel’s Government Companies Authority advances plans for a Rafael IPO, alongside a possible minority share offering in Israel Aerospace Industries.

Rafael’s potential valuation is estimated at around NIS 60 billion. The sale of subsidiaries such as mPrest, Controp, or Aeronautics could materially reshape that number.

Rafael has publicly denied that negotiations are currently underway for Aeronautics or Controp, stating that no formal request has reached its board. It also emphasized that any transaction would require strict regulatory approval from the Ministry of Defense and the Government Companies Authority.

Ondas, for its part, says it is injecting capital into Israel to strengthen the defense tech ecosystem and describes itself as fully transparent.

In a market where billions move quietly and classified knowledge travels with human memory, transparency is often in the eye of the beholder.

DroneXL’s Take

Ondas is not shopping at the edges of Israel’s defense ecosystem. It is targeting the nerve centers.

When a US listed holding company with undisclosed major backing acquires nine Israeli defense firms in rapid succession and recruits their former leadership, regulators are right to move slowly.

The real question is not whether Ondas can afford Aeronautics. It is whether Israel is comfortable exporting that much operational DNA through corporate transactions.

With Rafael potentially heading toward an IPO, these decisions will shape not just one company’s balance sheet, but the architecture of Israel’s defense industry for the next decade.

Photo credit: Rafael, Ondas.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

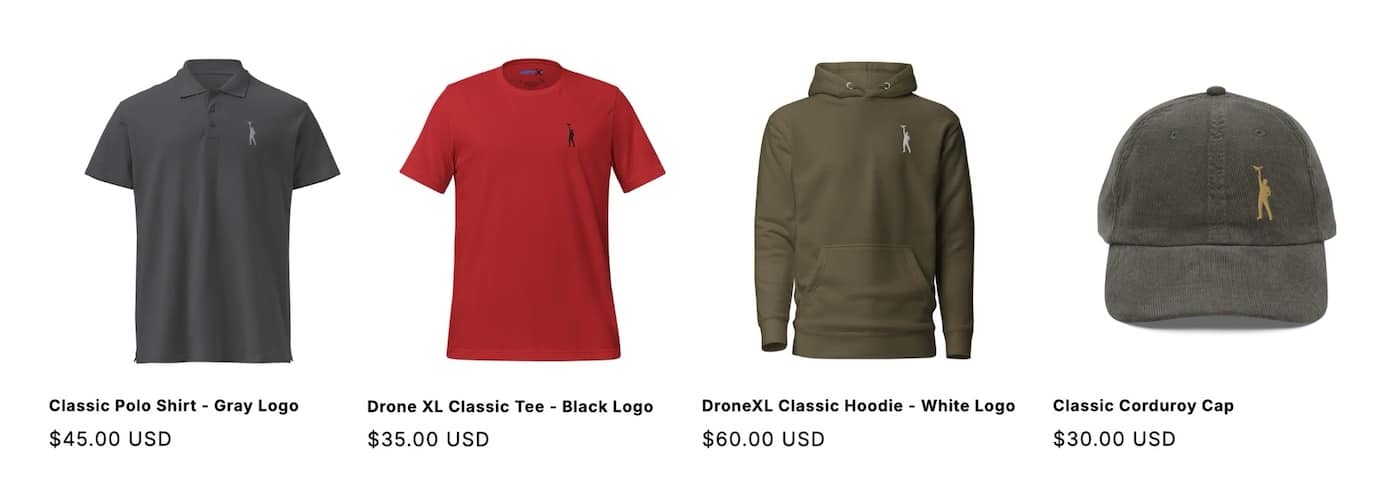

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.