Farmers eye American-made options as DJI nears FCC Covered List deadline

Check out the Best Deals on Amazon for DJI Drones today!

Circle the date: December 23, 2025. If no audit lands by then, new DJI sales could go dark—and growers will need a Plan B

An emerging U.S. agricultural drone sector is bracing for a decisive policy deadline that could curtail new DJI sales by year-end, even as domestic maker Hylio moves to expand output—setting up a real test of whether American production can cover the gap for growers who’ve rapidly adopted spray drones for post‑rain applications, cover crop seeding, and hard‑to‑reach terrain.

What’s at stake: a default ban trigger on DJI

Under last year’s National Defense Authorization Act, DJI will be automatically added to the FCC’s “Covered List” unless a federal agency completes a formal security review by December 23, 2025—effectively blocking new imports and sales in the U.S. if no audit occurs, a scenario for which no agency has yet stepped forward. Industry watchers note that, despite no outright ban today, customs holds tied to the Uyghur Forced Labor Prevention Act and the suspension of new FCC equipment authorizations have already tightened DJI supply, contributing to widespread product shortages at U.S. dealers.

This development raises questions about near‑term availability for farmers who’ve leaned on Chinese platforms—particularly DJI and Autel—for spray missions, mapping, and field scouting, reports the North Dakota Monitor.

Rapid adoption: millions of acres and new rural revenue

Spray drones are no longer niche. Farmer‑operators and custom applicators reportedly treated more than 10.3 million acres across 42 states in 2024, generating about $215 million in rural service revenue from drone operations—not hardware sales—according to data circulated by the American Spray Drone Coalition and echoed by land‑grant extension guidance. Those figures underscore how quickly drones have moved from trials to routine, time‑sensitive fieldwork, especially when heavy ground rigs risk getting stuck or manned aircraft are backlogged.

Building on that, coalition survey data shows the ramp: in 2023, drones covered 3.7 million acres across 41 states, suggesting a sharp year‑over‑year acceleration as operators scaled fleets and workflows.

Price, control, and the ag use case

Cost remains a clear driver. Large ground sprayers can run into the high six figures, while new ag spray drones commonly price in the $25,000–$60,000 range, with typical 20–30ft spray swaths versus 120ft booms on self‑propelled rigs; operators trade throughput for flexibility, rapid post‑rain access, and precision on uneven ground. Extension specialists note modern platforms carry 2.5–18 gallons, often apply at 1.5–2 gallons/acre, and now feature terrain‑following sensors and multi‑direction obstacle avoidance—technology that shortens learning curves and broadens field conditions where drones pencil out.

Policy pressure meets production reality

The core risk for ag pilots and co‑ops is timing. If DJI defaults onto the FCC’s Covered List after December 23, 2025, new units and replenishment inventory could be restricted just as spray capacity is needed seasonally, with knock‑on effects for parts and authorizations. Meanwhile, some shipments have already faced customs delays under forced‑labor enforcement, tightening availability this year.

Domestic alternatives are emerging but still scaling. Texas‑based Hylio says it is expanding manufacturing at a new 40,000‑sq‑ft facility near Houston to lift annual output toward 5,000 units by 2028, up from an estimated 500–1,000 per year today, a roughly 5× capacity increase tied to new automation and floor space. The company raised additional funding to accelerate the build‑out and reports a growing order backlog as U.S. buyers hedge policy risk with American‑made airframes and software.

Can U.S. makers fill a sudden gap?

Even with added capacity, a near‑term shortfall is possible if Chinese platforms are broadly restricted before domestic production fully ramps, particularly for agencies and operators that rely on specific payloads, swarming approvals, or established service ecosystems. Still, industry advocates argue that a diversified supplier base could improve resilience over time, pressuring prices down and quality up as U.S. manufacturers scale into the segment.

For farm businesses, the operational calculus is practical: weighing the lower up‑front cost and mature ecosystems of Chinese models against service continuity and regulatory certainty from U.S. platforms. If policy clocks run out without an audit, the market may encounter a constrained 2026 buying season—one that rewards operators with flexible fleets, spare batteries, and parts on hand, and favors vendors able to deliver airframes and support from U.S. soil.

Photos courtesy of DJI and Hylio.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

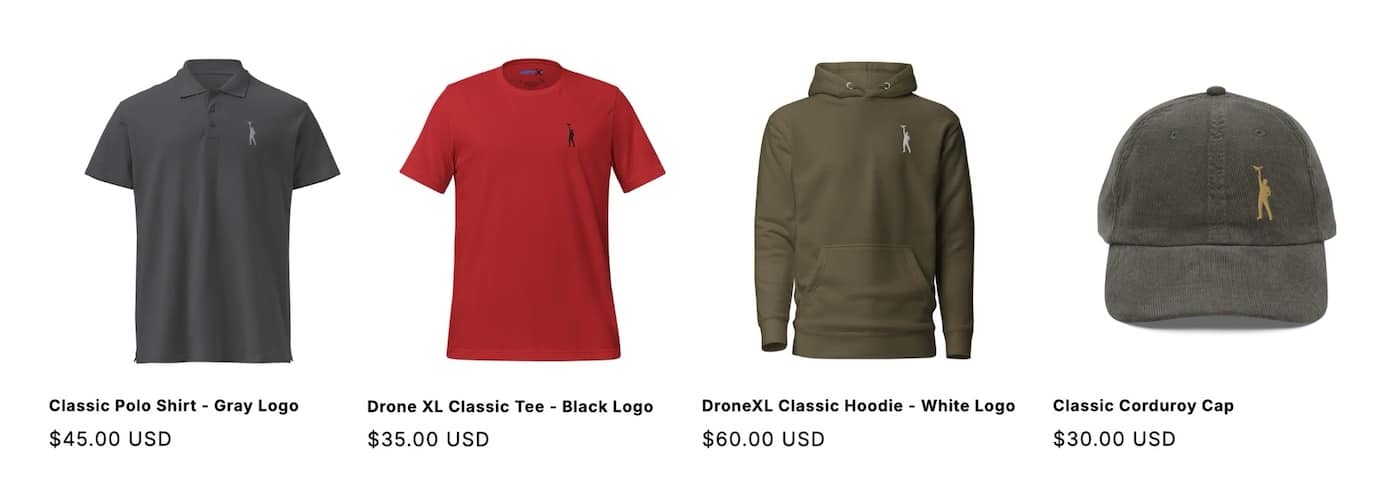

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.