Estonian Drone Maker Threod Explores Sale as Ukraine War Fuels Demand Surge

Check out the Best Deals on Amazon for DJI Drones today!

Threod Systems, an Estonian drone manufacturer, is considering a sale to capitalize on the rapid growth in demand for unmanned aircraft driven by the ongoing conflict in Ukraine, according to Bloomberg.

Rapid Revenue Growth and Customer Base

Threod Systems achieved €38 million ($44 million) in sales for 2024, marking an 87% increase from the previous year. This expansion reflects the company’s role in supplying surveillance drones to Ukraine, where they see regular battlefield use, and to seven NATO countries, including the UK, Poland, and Lithuania.

Founded in 2012, Threod employs about 160 people and produces fixed-wing drones, vertical takeoff and landing (VTOL) models, and supporting systems like launchers and optics. The company has also engineered small electro-optical payloads, known as gimbals, equipped with laser designators. These components mount on various drone types and enable precise threat identification and targeting.

Chief Executive Officer Arno Vaik stated in a November 2024 interview that the company aims to reach €100 million in revenue within a few years. This ambition aligns with Threod’s current trajectory, as advisers gauge interest from potential buyers, including major European defense firms and private equity groups.

Broader Geopolitical and Industry Trends

Investor enthusiasm for European defense startups has intensified amid shifting geopolitical dynamics and extensive rearmament efforts across the continent. European nations face pressures from Russian President Vladimir Putin and US President Donald Trump, prompting preparations to allocate trillions of euros to defense. In June, NATO members committed to raising defense spending to 5% of gross domestic product, following Trump’s criticisms of allies’ security contributions.

Drones offer a cost-effective alternative to traditional missiles and have proliferated in the Ukraine war, aiding Kyiv against a superior adversary. Russia has escalated its use of long-range unmanned aerial vehicles (UAVs), deploying large barrages after Ukrainian drone strikes on its air bases in June. This development has spurred NATO members to increase UAV investments, challenging China’s historical dominance in the sector.

Implications for Drone Technology and Market Dynamics

Threod’s potential sale highlights opportunities for consolidation in the drone industry, where technical advancements in surveillance and targeting systems draw significant attention. The integration of laser-equipped gimbals enhances operational precision, allowing drones to support reconnaissance and strike missions effectively. This raises questions about how such technologies might evolve under new ownership, potentially accelerating innovation in VTOL and fixed-wing designs.

Building on that, several drone companies are securing funding or eyeing public offerings. For instance, Destinus SA, which supplies weapons to Ukraine, is negotiating funding at a valuation up to €1.5 billion. Tekever Ltd. recently raised capital at over £1 billion ($1.4 billion) after securing a Royal Air Force contract. German firm Quantum Systems Pte Ltd., backed by Peter Thiel, obtained €160 million in May from investors like Balderton Capital, Airbus-linked entities, and Porsche SE.

These trends suggest a maturing market where European manufacturers gain ground, driven by regulatory shifts toward higher defense budgets and a focus on domestically produced UAVs. For drone professionals, this could mean expanded access to advanced systems, though economic implications include rising costs amid increased demand. Regulatory changes, such as NATO’s spending targets, may further influence procurement strategies, favoring reliable suppliers like Threod.

The evolving landscape underscores the strategic importance of drones in modern warfare, with implications extending to recreational pilots through potential trickle-down innovations in optics and launch systems. However, the sector must navigate geopolitical risks, including supply chain dependencies and international tariffs.

Photos courtesy of Threod Systems

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

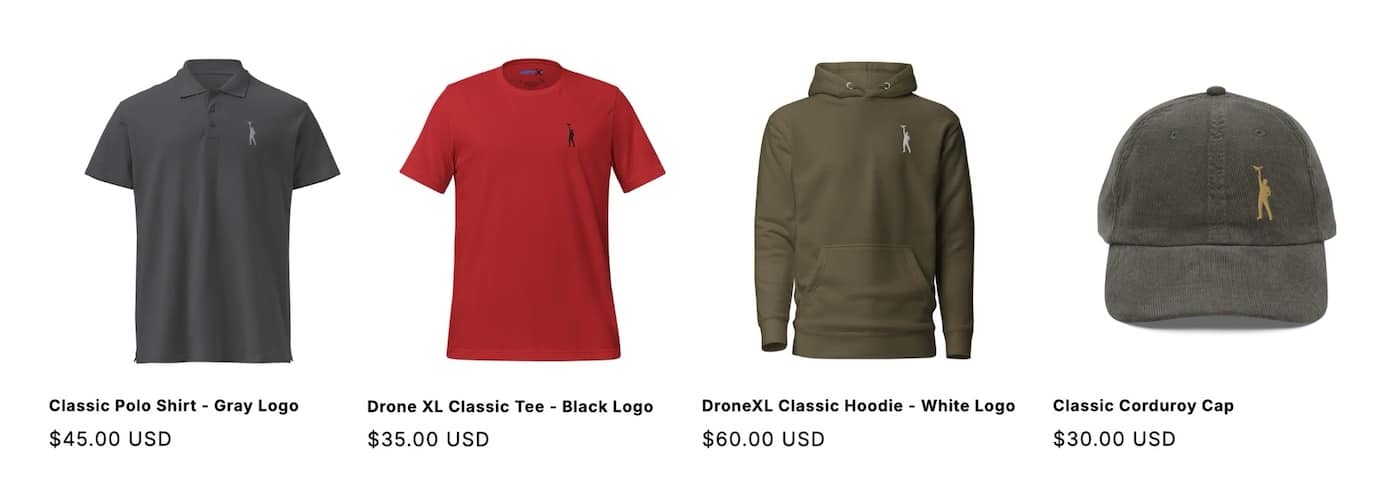

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.