Quantum Systems eyes early 2027 IPO as Morgan Stanley tapped for fresh $710 million funding round

Check out the Best Deals on Amazon for DJI Drones today!

We have been tracking Quantum Systems‘ rise from small civilian drone maker to what the company calls Europe’s first “triple unicorn” in dual-use technology for nearly two years now. Today, the trajectory just got a lot steeper.

The Peter Thiel-backed German drone company is preparing for an initial public offering that could take place by early 2027, according to a report from German business publication Manager Magazin, picked up by Reuters, citing unnamed sources.

Here is what we know:

- The IPO: Quantum Systems is preparing to go public, with a listing possible by early 2027.

- The money: Management has tapped Morgan Stanley to run a new financing round worth 400 million to 600 million euros ($470-710 million).

- The non-denial: A Quantum spokesperson declined to comment, saying the company “generally does not comment on financing rounds and related speculation.”

- The source: Manager Magazin broke the story. Reuters picked it up and confirmed the details.

Quantum Systems has raised $739 million and tripled its valuation in 2025

Quantum Systems is a German drone maker headquartered in Gilching, near Munich, that builds AI-powered eVTOL reconnaissance drones for military, government, and commercial customers. The company was founded in 2015 by Florian Seibel, a former Bundeswehr helicopter pilot and aerospace researcher, and now employs roughly 1,000 people across operations in Germany, Ukraine, Romania, the UK, the US, and Australia.

The IPO talk follows a year of aggressive growth. In November 2025, Quantum Systems tripled its valuation to 3 billion euros ($3.5 billion) after closing a 180 million euro funding round led by Balderton Capital. That brought total 2025 funding to 340 million euros, the largest private capital raise in Europe’s dual-use sector last year. Peter Thiel first invested in 2022 and has remained a backer through subsequent rounds.

If the new 400-600 million euro round closes before an IPO, it would push Quantum Systems’ total capital raised well past the 1 billion euro mark. PitchBook data already lists the company at $739 million raised. It is worth noting that as recently as November 2025, CFO Jonas Jarosch told the Financial Times that an IPO was just one of two options being considered, with a private sale as the alternative. Revenue projections also vary depending on the source: Jarosch told the FT that 2025 sales would double to more than 200 million euros from 113 million euros in 2024, while materials around the November funding round cited 300 million euros for 2025 and more than 500 million euros for 2026. About 95% of revenue comes from military customers.

A $246 million German Army contract and two acquisitions built the IPO case

The IPO push follows a quarter of stacked wins that would make any prospectus look attractive. Co-CEO Sven Kruck, who shares leadership with Seibel and oversees sales, operations, and finance, has been building exactly the kind of revenue story public market investors want to see.

In December 2025, we reported that the company secured a $246 million (210 million euro) contract to deliver 520 Falke surveillance drone systems to the German military in 2026, with options for 500 more units through 2032. That single contract was worth roughly 75% of projected 2025 revenue.

The same month, Quantum Systems acquired FERNRIDE, a Munich-based autonomous trucking company, to expand from aerial intelligence into autonomous ground mobility. FERNRIDE became the first company in Europe to receive TUV approval for autonomous trucks in 2025 and had already begun testing with the German Armed Forces. Earlier in 2025, the company also acquired drone manufacturer AirRobot and unveiled the Jaeger, a new counter-drone system designed to intercept hostile unmanned aircraft, broadening the product line beyond reconnaissance.

Multiple acquisitions, a massive military contract, and a tripled valuation within a single year. That is the kind of momentum that makes investment bankers pick up the phone.

Quantum Systems’ combat-proven record separates it from the pack

What makes Quantum Systems different from many defense tech startups chasing IPOs is that its drones actually work under fire. The company’s Vector and Falke systems have logged thousands of combat hours in Ukraine since Russia’s 2022 invasion. When we profiled CEO Florian Seibel’s VTOL drone family in June 2024, he told us 400 reconnaissance drones were already operating in Ukraine with 800 more scheduled for delivery.

That battlefield feedback loop is something money cannot buy. The Vector’s ability to operate in GPS-denied environments, where Russian electronic warfare regularly jams satellite navigation, has been validated under real combat conditions. This is not a PowerPoint demo. It is thousands of hours of operational data collected under enemy fire.

The contrast with Seibel’s other venture is instructive. He spun off Stark Defence in 2024 for attack drones after some Quantum Systems investors opposed weaponized systems. In October 2025, we reported that Stark’s Virtus drones failed to hit a single target across four separate military trials. One drone missed by more than 150 meters before crashing into woodland. Another’s battery caught fire on impact. Yet Germany awarded Stark contracts that could reach 2.86 billion euros.

Quantum Systems has no such controversy on its record. Its drones work. They have worked for nearly four years in the most demanding conditions imaginable.

Europe’s defense spending boom creates the IPO window

The timing of this IPO push is not accidental. European defense spending is surging in response to the war in Ukraine, and drone companies are riding the wave. Germany alone has committed 10 billion euros to unmanned aerial vehicles as part of a 377 billion euro defense spending plan through 2035. Helsing and Stark just landed 600 million euros in German loitering munition contracts, with potential value reaching 4.3 billion euros.

Competitor Helsing reached a 12 billion euro valuation in 2025, proving that public and private market appetite for European defense tech is real. A Quantum Systems IPO at or above its current 3 billion euro valuation would make it one of the most significant defense tech listings in European history.

DroneXL’s Take

I have been covering Quantum Systems since before most investors knew the company existed, and nothing about this IPO report surprises me. The groundwork has been laid methodically: a tripled valuation, the Falke contract locking in military revenue, two acquisitions broadening the technology stack, the Jaeger expanding the product line into counter-UAS, and now Morgan Stanley at the table. This is textbook IPO preparation.

What does surprise me is the size of the pre-IPO round. At 400-600 million euros, this would be one of the largest private raises in European defense tech. It tells me Quantum Systems wants to enter public markets from a position of strength, with a war chest large enough to fund manufacturing scale-up and further acquisitions without needing to raise again immediately after listing.

The combat-proven angle is the real differentiator here. Every defense tech IPO prospectus claims operational readiness. Quantum Systems can point to years of actual battlefield data from Ukraine, GPS-denied navigation that works when it counts, and a military customer base that keeps coming back. That is a story public market investors will pay a premium for.

My prediction: if the financing round closes by mid-2026 and European defense sentiment holds, expect the IPO to land in Q1 2027 at a valuation north of 5 billion euros. A private sale remains technically on the table, as CFO Jarosch said in November. But tapping Morgan Stanley to run a pre-IPO round worth up to 600 million euros is not what you do when you are leaning toward a quiet exit. The FERNRIDE acquisition signals Quantum Systems is positioning itself not just as a drone company but as a multi-domain autonomous systems platform. That broadens the addressable market and gives institutional investors the growth narrative they need.

Watch for Morgan Stanley to bring in co-underwriters from European banks. A dual listing in Frankfurt and possibly London would maximize access to both European defense capital and transatlantic institutional money.

Editorial Note: AI tools were used to assist with research and archive retrieval for this article. All reporting, analysis, and editorial perspectives are by Haye Kesteloo.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

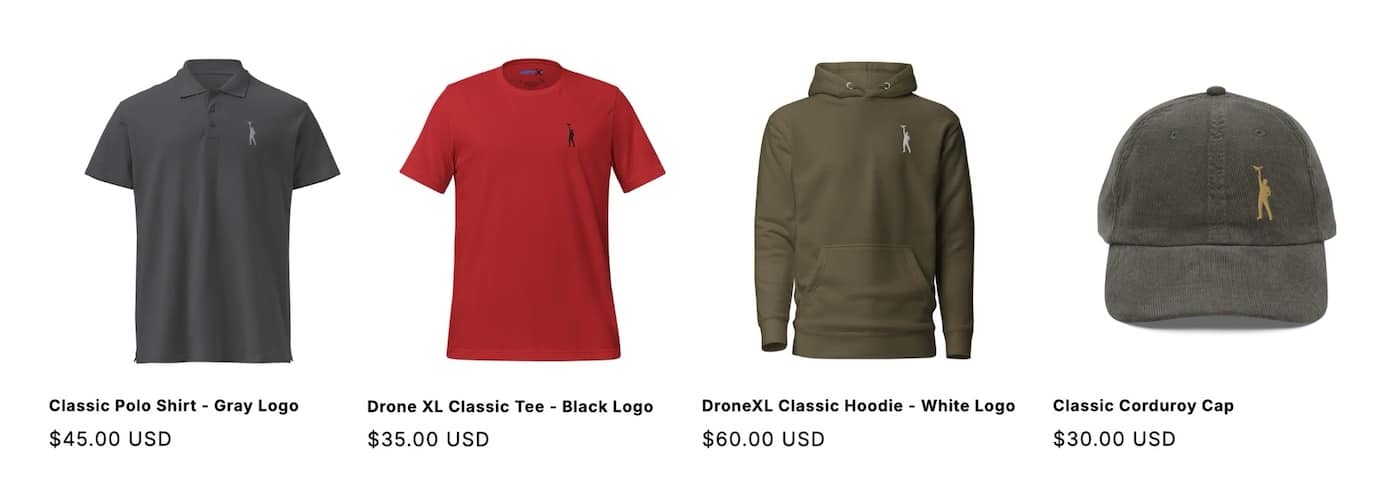

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.