Drone Detective Bot Tracks DJI-Linked Companies Through Wireless Frequency Fingerprints

Check out the Best Deals on Amazon for DJI Drones today!

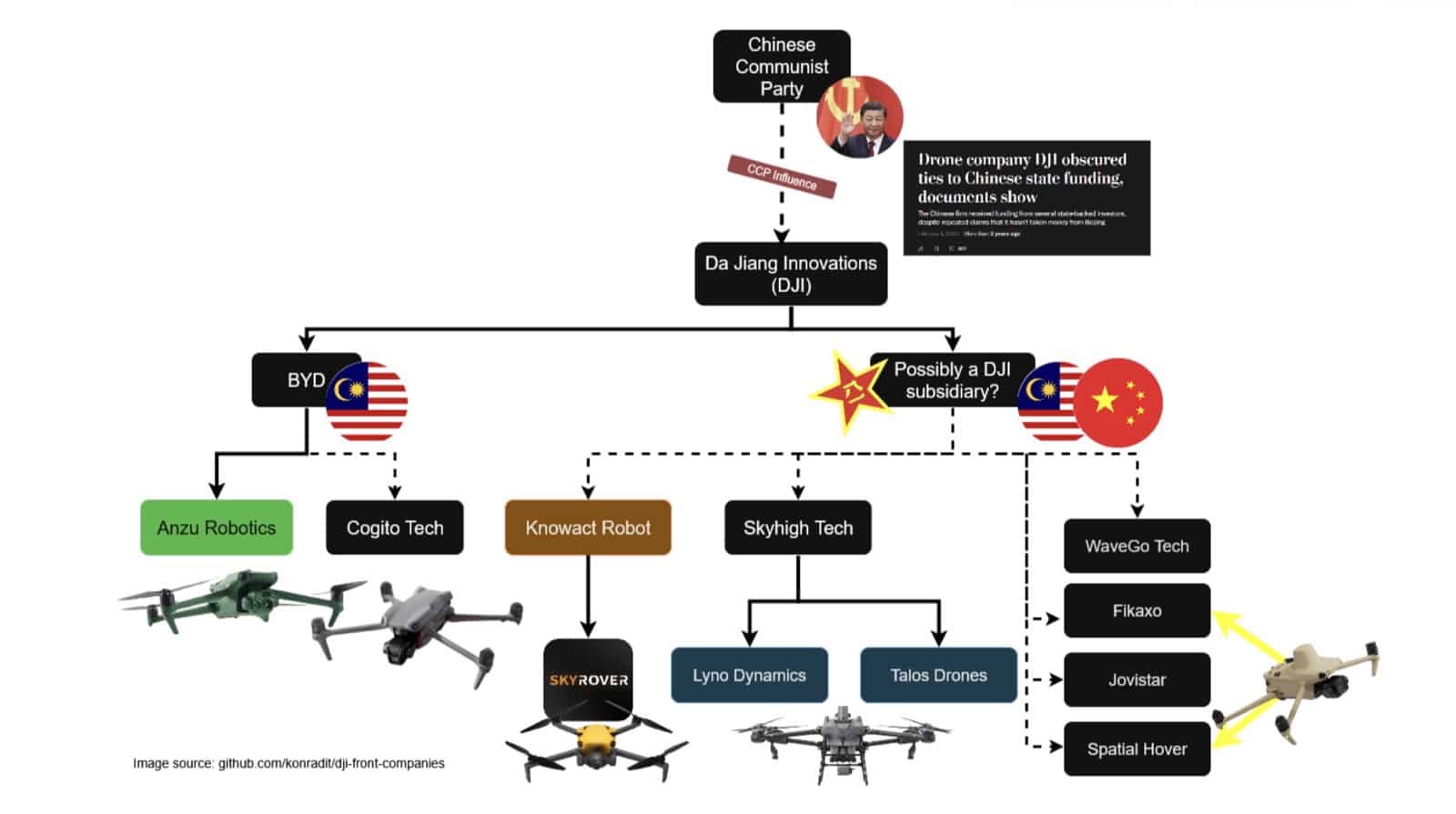

Security researcher, Konrad Iturbe has created an automated system that identifies companies selling DJI-based drones under alternative brand names by detecting the unique wireless “fingerprints” embedded in their FCC filings—a technical paper trail that reveals the true origins of drone hardware regardless of corporate branding.

Iturbe’s detection methodology, detailed in his October 25, 2025 research paper “To Catch A Vibe,” demonstrates how DJI’s proprietary OcuSync transmission system uses specific radio frequencies that act as an unmistakable signature, revealing manufacturer identity regardless of corporate branding or Malaysian manufacturing locations.

The automated GitHub-based system scans FCC databases daily for drones using DJI’s distinctive frequency pairs—particularly the 5745.5-5829.5 MHz band used across DJI’s professional lineup. When new registrations appear matching these technical specifications, the bot flags them and updates a public tracking list.

The system has identified at least a dozen companies selling DJI-based drones under alternative brands, including Cogito Tech, Spatial Hover, Lyno Dynamics, Fikaxo, Jovistar, WaveGo Tech, Knowact Robot, Skyhigh Tech, Skyany, and Skyrover—all submitting FCC applications for drones with identical OcuSync chipsets and frequency profiles.

Technical Fingerprints Reveal True Manufacturer

DJI’s proprietary OcuSync communication hardware represents both the company’s competitive advantage and its Achilles heel in regulatory circumvention. Unlike competitors using open-source flight controllers and off-the-shelf radio equipment, DJI designed custom chipsets optimized for specific frequency bands.

“I built a small bot that finds these shells,” Iturbe explained in previous coverage. “Every day, the bot goes to the FCC and it searches through the listings for the DJI OcuSync, specific frequencies.”

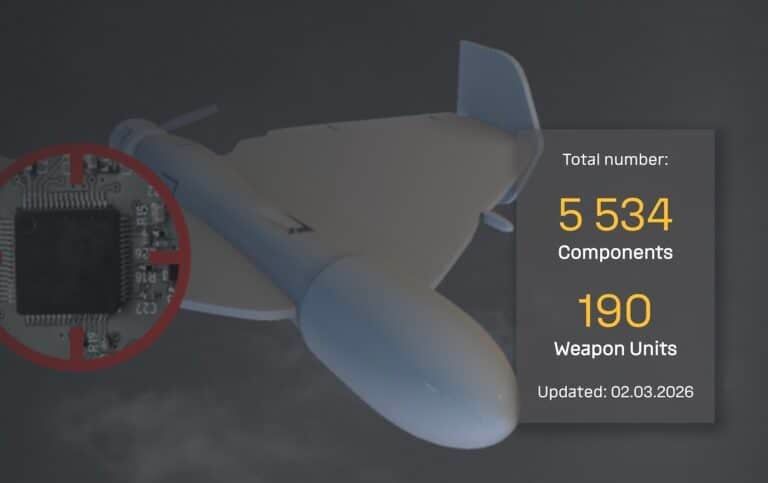

The technical evidence extends beyond frequency matching. Analysis reveals DJI’s proprietary P1 Pigeon chipsets, identical OFDM structures with 601 sub-carriers, and specific synchronization sequences appearing across all suspected shell company products. Each drone broadcasts unencrypted DroneID packets every 640 milliseconds containing telemetry that reveals true manufacturer identity despite corporate rebranding efforts.

The FCC requires every RF-capable device sold in the United States to undergo certification specifying exact operating frequencies. Because OcuSync’s antennas and chips were designed at the hardware level for specific frequency bands, altering these parameters would require fundamental re-engineering—making frequency-based detection nearly foolproof.

Technical Evidence Reveals Connections Between Brands

Beyond frequency fingerprints, Iturbe’s investigation uncovered evidence of connections between supposedly independent companies. A WaveGo Tech FCC filing included documentation from SZ Knowact Robot Technology Co., Ltd—a known DJI-linked company—suggesting shared infrastructure in regulatory paperwork.

The Fikaxo E1 drone—a rebranded DJI Mavic 3 Enterprise in beige—disappeared from Fikaxo Technology Inc’s website within days of DroneXL’s September 26 coverage. The identical drone model reappeared as Spatial Hover’s E Series and T Series products on a website first spotted October 1, 2025.

“A drone cannot simply migrate from one supposedly independent company’s product lineup to another unrelated manufacturer’s website without coordinated control,” industry observers noted following the discovery.

FCC documentation for Skyhigh Tech LLC components revealed DJI logos still visible on WiFi antenna diagrams—physical evidence appearing in official government filings for hardware using DJI components. The filing connected agricultural drone retailer Talos Drones to this network, with user reports indicating Talos sells Skyhigh-branded products alongside its role as an official DJI authorized dealer.

September Surge Precedes December Ban Deadline

The pace of shell company creation accelerated dramatically in September 2025, with four new entities submitting FCC applications in just three weeks:

- Spatial Hover Inc submitted two drones (September 30, 2025)

- Lyno Dynamics LLC filed applications (September 29, 2025)

- Jovistar Inc submitted filings (September 25, 2025)

- Fikaxo Technology Inc registered equipment (September 19, 2025)

The surge directly correlates with mounting political pressure. Section 1709 of the FY2025 National Defense Authorization Act requires a U.S. national security agency to determine whether DJI poses an unacceptable risk by December 23, 2025. If no agency completes the mandated security review by that deadline, DJI will automatically be added to the FCC’s Covered List—effectively banning new product sales.

As of late October 2025, no federal agency has scheduled the required security assessment. The ongoing Trump administration government shutdown has blocked new FCC registrations, temporarily halting DJI’s ability to register additional shell companies.

Several alternative brand operations remain dormant with “coming soon” landing pages, suggesting these entities were established ahead of potential regulatory changes.

Alternative Brand Strategy Spans Multiple Market Segments

The network of DJI-based alternative brands targets multiple market segments. Cogito Tech’s Specta Air represented a rebranded DJI Mavic Air 3 for consumers, while Spatial Hover and Fikaxo products match DJI Mavic 3 Enterprise specifications for commercial operators.

Jovistar’s recent FCC filing matches specifications for the unreleased DJI Mini 5 Pro, including LiDAR capability and battery specifications identical to DJI’s consumer flagship. The precise battery specification matching and laser product classification suggest carefully engineered workarounds to regulatory restrictions.

The agricultural sector faces particular exposure. Skyhigh Tech supplies components to Talos Drones, which markets agricultural sprayers alongside genuine DJI Agras models. This creates distribution chains where Skyhigh manufactures components bearing DJI technical specifications, Talos acts as retailer, and multiple drone brands emerge from the same supply chain.

Skyany’s X1 drone—essentially a rebranded DJI Mini 4 Pro—currently sells on Amazon for $758 with Prime shipping, demonstrating how shell products reach mainstream retail channels.

Congressional Oversight Cites Research

Several lawmakers have referenced Iturbe’s technical research to advance oversight efforts. The House Select Committee on the CCP sent letters to the Department of Commerce regarding Anzu Robotics and Cogito Tech in August 2024.

Senator Rick Scott’s office issued a formal letter raising concerns about the shell company strategy’s implications for national security policy. Representative Elise Stefanik has repeatedly cited the expanding network in arguing for stricter enforcement.

The automated detection system provides regulators with a technical roadmap for identifying disguised DJI products—evidence that doesn’t rely on corporate disclosures or business intelligence but rather on immutable hardware specifications filed with federal agencies.

FCC Vote Targets Component-Based Workarounds

The Federal Communications Commission voted 3-0 on October 28, 2025, to grant itself retroactive authority to ban equipment containing components from Covered List companies—a rule change that could affect DJI’s alternative brand strategy.

The new rule allows the FCC to revoke authorizations for devices that weren’t manufactured by listed entities but contain their technology. Companies marketing DJI-designed drones with DJI OcuSync chipsets could potentially fall within this prohibition if DJI is added to the Covered List.

Critical clarification: DJI is not currently on the FCC’s Covered List, meaning this enforcement authority has no immediate effect. However, if DJI is automatically added on December 23, 2025, the retroactive provisions could impact both branded DJI products and alternative brand drones containing DJI components.

DroneXL’s Take

We’ve been tracking this alternative brand proliferation since Konrad Iturbe first documented Cogito Tech’s Specta drones back in March 2024. What started as one or two entities has grown into a documented network spanning at least a dozen companies—all using DJI technology under different brand names.

Iturbe’s automated detection system represents something genuinely innovative in corporate transparency: open-source technical analysis that makes alternative branding strategies visible in real-time. The frequency fingerprinting methodology works because it exploits fundamental engineering decisions—you can change the name on the box, but you can’t hide the proprietary chipsets inside without complete re-engineering.

The technical evidence keeps accumulating. Document connections linking WaveGo to Knowact Robot. The Fikaxo drone model appearing on Spatial Hover’s website shortly after disappearing from Fikaxo’s site. DJI logos visible in supposedly independent manufacturers’ FCC component diagrams. The pattern suggests coordinated alternative branding rather than genuinely independent manufacturers.

But here’s the context that matters: this alternative brand proliferation didn’t happen in a vacuum. DJI has faced years of escalating political pressure in the United States—much of it driven by aggressive lobbying from competitors rather than verifiable security evidence. Skydio’s pivot from consumer products to government contracts—accompanied by substantial legislative advocacy spending—reveals the economic interests behind much of the anti-DJI legislation.

When a company controlling 70% of the global drone market faces potential exclusion from the world’s largest economy, it will seek alternative distribution channels. Whether those alternatives comply with the letter and spirit of U.S. regulations is a legitimate question. But it’s equally legitimate to ask whether the regulatory pressure itself is genuinely about security or about using national security rhetoric to eliminate competition for politically connected domestic manufacturers.

Representative Stefanik’s December 2024 NDAA provision establishing the December 23 deadline didn’t emerge solely from intelligence briefings. It emerged alongside a well-funded lobbying apparatus with direct connections to her office. The fact that no federal agency has volunteered to conduct the mandated security review—despite having nearly a year to do so—suggests the automatic ban may be the intended outcome rather than a fallback provision.

For American drone operators, the situation has become untenable. The accessibility crisis is already severe. DJI’s U.S. inventory shows near-total depletion. Alternative brand workarounds face component parts restrictions. And the companies claiming to offer alternatives? They’ve abandoned the consumer market entirely or price their products at 5-10x DJI equivalents while offering inferior performance.

We oppose regulatory evasion, but we’re equally opposed to regulatory capture disguised as data security policy. If DJI poses genuine security threats, those concerns deserve transparent technical audits conducted by actual security agencies—not legislative deadlines designed to trigger automatic bans. If the concerns are legitimate, evidence should drive policy. If they’re not, American pilots and businesses shouldn’t suffer collateral damage from protectionist trade policy.

Iturbe’s detection system will continue operating regardless of the December deadline outcome. His GitHub repository updates daily, providing transparent documentation that federal agencies have failed to produce despite years of claiming security threats. That level of accountability—built by one researcher with technical skills and public data—highlights the dysfunction in how these policy debates have proceeded.

The real question isn’t whether DJI created alternative brands—the technical evidence makes that clear. The question is whether U.S. policymakers will address security concerns through transparent technical processes, or whether they’ll continue using national security rhetoric to eliminate competition for politically connected manufacturers while leaving American operators without viable alternatives.

What do you think? Should regulators focus on technical security audits or is the alternative brand strategy itself the problem? Share your thoughts in the comments below.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.

I am starting a new drone AG. spraying business. Now the only drone option for my business to start with is a company out of Texas.

And I am not sure they dont use DJI technology.

The cost is almost 25% more with no background history of success or failure.

This is going to put a real damper on future and existing drone companies.

Shame on our politicians for thinking of only lining there packets, without even viewing the truth on the security concerns.