DJI Drone Stock Crisis Deepens as U.S. Ban Looms: Why Are Shelves Bare?

Check out the Best Deals on Amazon for DJI Drones today!

If you’re eyeing a DJI drone to enhance your aerial photography or recreational flying, the options are dwindling fast. As of June 22, 2025, DJI’s official website and major U.S. retailers like B&H Photo, Adorama, and Amazon report near-total stock depletion across their drone lineup. From the budget-friendly DJI Neo to the cinematic Inspire 3, nearly every model is out of stock, on backorder, or outright unavailable. With a U.S. ban mandated by the National Defense Authorization Act (NDAA) set for December 23, 2025, unless a security audit clears DJI’s Chinese-made drones, political pressure may be the driving force behind this scarcity. Buyers are left wondering: is this a calculated move to phase out DJI in the U.S.?

UPDATE 6/24 from DJI: “DJI remains committed to the US market. As we’ve previously shared, DJI has been working with U.S. Customs and Border Protection (CBP) to resolve a custom-related misunderstanding. Unfortunately, this has impacted our ability to stock and import drones and parts. We understand the frustration among our customers, but remain hopeful that this will be resolved.”

Comprehensive Stock Shortages Across DJI’s Drone Range

The stock crisis spans DJI’s entire portfolio, affecting models tailored to beginners, hobbyists, and professionals alike.

The DJI Mavic 4 Pro, boasting a 360-degree rotating gimbal and 6K/60fps HDR video, isn’t for sale in the U.S., a decision tied to Trump-era tariffs and customs delays.

The Mavic 3 Pro’s Fly More Combo and Cine packages linger at B&H Photo, but most variations are discontinued or out of stock elsewhere.

The Air 3S, with its dual 1-inch CMOS cameras and 45-minute flight time, is unavailable at DJI.com and B&H Photo, with only Adorama offering the RC-N3 variant on backorder.

The Air 3 follows suit, depleted across all platforms except for limited Amazon third-party supplies.

The DJI Mini series, popular for its sub-250-gram portability, faces similar woes. The Mini 4 Pro, with a 4K gimbal and 20-kilometer transmission, is out of stock everywhere, while the Mini 3 Pro and Mini 3 are not available or on backorder.

The Mini 4K and Mini 2SE show slight exceptions—B&H Photo stocks a special Mini 2SE combo and the Flip—but availability remains scarce.

The Avata 2 and original Avata, known for FPV immersion with 4K at 100 fps, have some options at Adorama, while the Neo and Inspire 3 are largely inaccessible. The FPV model, with its 155° super-wide FOV, is also out of stock or backordered. A detailed overview highlights the extent:

| Model | DJI.com | BandH Photo | Adorama | Amazon |

|---|---|---|---|---|

| Mavic 4 Pro | Not for sale | Not for sale | Not for sale | Not for sale |

| Mavic 3 Pro | Out of stock, all | Discontinued, some Cine/Fly More available | Backorder | Limited third-party supplies |

| Air 3S | Out of stock, all | Out of stock, all | Backorder (except RC-N3) | Limited third-party supplies |

| Air 3 | Out of stock, all | Out of stock, all | Backorder | Limited third-party supplies |

| Mini 4 Pro | Out of stock, all | Out of stock, all | Backorder | Limited third-party supplies |

| Mini 3 Pro | Not available | Not available | Backorder | Not available |

| Mini 3 | Out of stock, all | Out of stock, all | Backorder | Limited third-party supplies |

| Mini 4K | Out of stock, all | Out of stock, all | Backorder | Limited third-party supplies |

| Mini 2SE | Out of stock, all | Special combo in stock! | Backorder | Limited third-party supplies |

| Flip | Out of stock | In stock! | Backorder (except with RC2) | Limited third-party supplies |

| Avata 2 | Out of stock | Out of stock | Some options left | Limited third-party supplies |

| Avata | Out of stock | Some in stock | Some options left | Limited third-party supplies |

| FPV | Out of stock | Out of stock | Backorder | Limited third-party supplies |

| Neo | Out of stock | Out of stock | Available | Limited third-party supplies |

| Inspire 3 | Out of stock | Out of stock | Backorder | Limited third-party supplies |

Compounding the issue, all accessories—batteries, controllers (e.g., RC 2 with a 5.5-inch 1080p screen), Inspire lenses, and charging hubs—are out of stock, leaving existing owners in a bind.

Political Pressure and the Looming DJI Drone Ban

The NDAA’s provision demands a U.S. government agency audit DJI’s drones for security risks by December 23, 2025, with failure triggering an automatic ban. No audit progress has surfaced by mid-2025, suggesting intentional delay.

This aligns with lobbying from U.S. drone manufacturers like Skydio and Brinc Drones, part of the Blue sUAS initiative, which pushes to replace Chinese drones with domestic alternatives.

Critics argue this isn’t about security but protecting a $4 billion U.S. drone market where DJI holds 90% of the hobby segment and 70% of the industrial sector. Tariffs and customs holds, as seen with the Mavic 4 Pro, amplify the squeeze, hinting at a coordinated effort to limit DJI’s presence.

DJI’s (forced) choice to skip the DJI Mavic 4 Pro U.S. launch, citing tariffs, and the rapid stock depletion of other DJI drones suggest preemptive action.

Without an audit, the ban will render stock issues irrelevant, potentially ending DJI’s U.S. sales by year-end. However, without any DJI drones for sale, the data security audit becomes irrelevant too.

Technical Features at Stake and User Challenges

These DJI drones offer cutting-edge tech now at risk. The Mavic 3 Pro’s 4/3-inch Hasselblad sensor captures 5.1K video, while the Air 3S’s dual cameras deliver 14 stops of dynamic range. The Mini 4 Pro’s omnidirectional sensing aids pros, and the Avata 2’s FPV goggles enhance immersion with 23-minute flight times. The Inspire 3’s 8K ProRes RAW suits cinema, and the Neo’s 135-gram frame suits beginners. Without these, drone service providers, filmmakers, surveyors, first responders, search and rescue crews, and hobbyists face capability gaps.

Third-party sellers offer limited relief—e.g., Mini 4 Pro bundles hit $1,500 USD from $1,099 USD—risking tariffs or delays. Existing users struggle without spare parts and accessories.

Industry Shifts and Economic Fallout

DJI’s market dominance could erode, boosting Skydio, Brinc and other Blue sUAS drone suppliers, though they do not cater to consumers and recreational drone pilots. The U.S. industry might see innovation stall if competition weakens, with prices rising as supply dries up. Third-party sales could surge, but import concerns grow.

For DJI, losing the U.S.—its largest market—may force a pivot to Asia or Europe, though production costs could rise. Users, especially small businesses, face higher costs and disrupted workflows.

Notably, these shortages are U.S.-specific; DJI drones, including the Mavic 4 Pro, remain widely available in Canada, Europe, and Asia, where no ban threatens. This regional disparity underscores political targeting, leaving U.S. pilots grounded while global markets thrive.

Photos courtesy of Air Photography.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

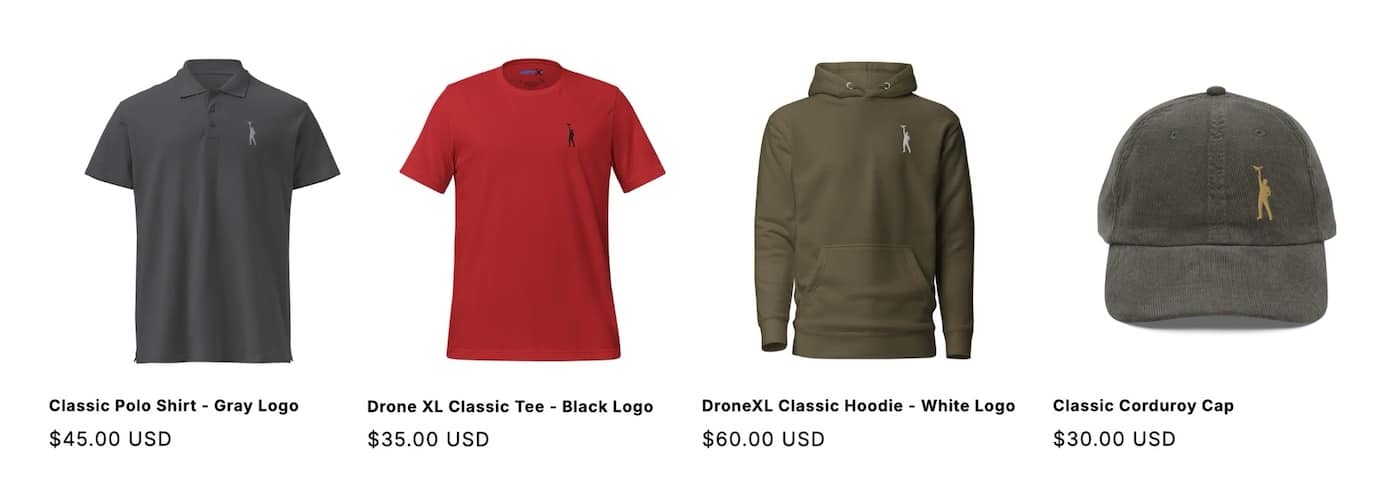

Check out our Classic Line of T-Shirts, Polos, Hoodies and more in our new store today!

MAKE YOUR VOICE HEARD

Proposed legislation threatens your ability to use drones for fun, work, and safety. The Drone Advocacy Alliance is fighting to ensure your voice is heard in these critical policy discussions.Join us and tell your elected officials to protect your right to fly.

Get your Part 107 Certificate

Pass the Part 107 test and take to the skies with the Pilot Institute. We have helped thousands of people become airplane and commercial drone pilots. Our courses are designed by industry experts to help you pass FAA tests and achieve your dreams.

Copyright © DroneXL.co 2026. All rights reserved. The content, images, and intellectual property on this website are protected by copyright law. Reproduction or distribution of any material without prior written permission from DroneXL.co is strictly prohibited. For permissions and inquiries, please contact us first. DroneXL.co is a proud partner of the Drone Advocacy Alliance. Be sure to check out DroneXL's sister site, EVXL.co, for all the latest news on electric vehicles.

FTC: DroneXL.co is an Amazon Associate and uses affiliate links that can generate income from qualifying purchases. We do not sell, share, rent out, or spam your email.